The Express Tribune explains foreign debt

In a series of charts and maps, The Express Tribune explains Pakistan's foreign debt, how it works, and how, for all the calls of 'trade not aid', the dependence looks set to continue.

Story by: Saim Saeed and Khurram Siddiqui

Creative by: Sawant Shah and Usman Khalid

1 Pakistan's Foreign Debt

$47 billion.

That's a lot. If this number is distributed across the population, each Pakistani currently owes Rs82,627. But as this feature is going to show, it's far smaller than what some other countries owe. That should not be cause for comfort, however. Just because Pakistan's foreign debt is much smaller than other countries does not mean that Pakistan has to worry less, or that its finances are in order. Far from it.

Despite owing a lot of money to other countries, a lot of countries still manage to be financially stable because the same countries are net creditors, meaning that they are owed more money than they owe to others. This is not the case with Pakistan. A country that is unable to pay its debt goes into default, like what has happened recently in Argentina, Greece and Zimbabwe. On various occasions, Pakistan has been close to defaulting but has been saved by last minute emergency loans. Pakistan's dependence on foreign loans, then, has put in a 'debt trap', meaning that it has to borrow more money to pay off the loans it already owes.

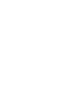

2 A history of dependence (1961 - 1985)

This chart demonstrates how intricately foreign assistance to Pakistan has been tied to its political conditions. The need for foreign assistance began shortly after independence. Pakistan received $121 million from 1951-1955. That figure nearly tripled in the next five years as Pakistan began to play an increasingly important role in the Cold War. A look at foreign assistance from 1961 to 1985 reveals some interesting, if not surprising, trends that correspond to Pakistan's politics. Foreign assistance dipped right after 1965 and 1971, as the international community placed sanctions on both Pakistan and India for the wars. Foreign aid also decreased after Ziaul Haq's coup, a move hardly popular with democracy supporting countries. But after the Soviet invasion of Afghanistan, the aid started flowing again. It was during Ziaul Haq's regime that Saudi Arabia also started giving money to Pakistan.

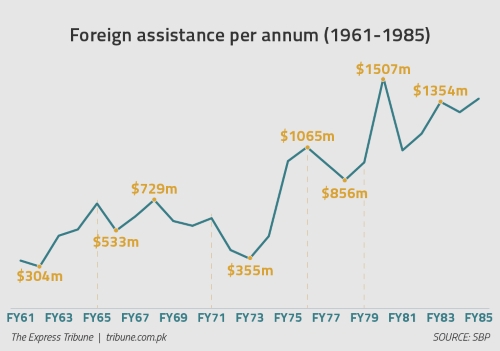

3 A history of dependence (1986 - 2010)

Foreign assistance peaked in Pakistan by the end of the Cold War. Throughout the 90s, American aid had significantly declined because of sanctions put in place over Pakistan's nuclear program, and partly because of the United States' withdrawal from the region. Aid actually decreased after Pakistan eventually conducted nuclear tests in 1998. It declined further after Musharraf's coup in 1999. Still, Pakistan's help was again required after the attacks on September 11 as part of the American 'War on Terror', and the aid started flowing again.

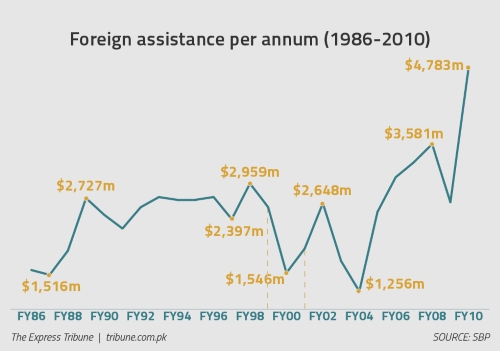

4 Pakistan's ever-dwindling foreign exchange reserves

Foreign exchange reserves is the foreign currency that a country keeps to make payments to other countries, mostly for importing things. While countries keep a host of currencies, the most common is the American dollar. This chart is a useful indication of how precarious Pakistan's foreign reserves are. The scale is simple: how many months of imports can a country's current stock of foreign reserves pay for? In Pakistan's case: not many. Last year, Pakistan barely had enough cash to pay for six weeks's worth of imports, and it's one of the main reasons why Pakistan has to borrow. In fact, it was to stave off this crisis that the government took out a $6.6 billion loan from the IMF last year. The loan is to be disbursed over three years, to make sure that Pakistan's reserves are shored up.

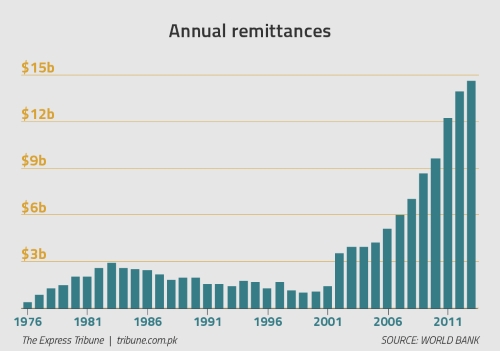

5 Remittances - Pakistan's saviour

Foreign debt almost always requires repayment in foreign currency, which renders Pakistan's foreign exchange reserves perpetually in danger of emptying. Over the years then, Pakistan has relied increasingly on money sent back by Pakistanis working abroad. Remittances have provided an immediate, steady and increasing flow of foreign exchange that have helped replenish Pakistan's reserves. This chart shows a remarkable rise in remittances, and while the chart ends in 2008, remittances have more than doubled since then - in 2014, they stood at $15.8 billion, making remittances recession-proof. Counter-intuitively, the trend is more a reflection of Pakistan's depressing economic outlook than a reason for optimism. It highlights that an increasing number of Pakistanis are leaving Pakistan to find work. That many of the workers are highly skilled may sustain the increase in remittances, but it also highlights brain drain.

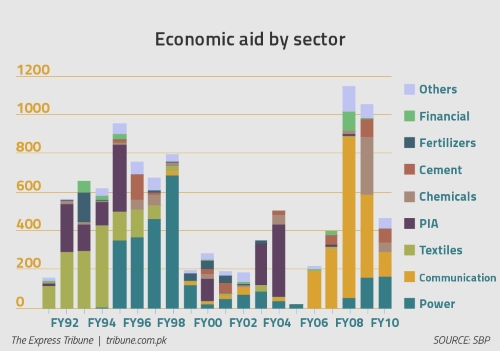

6 Breakdown of economic aid

Pakistan's economic priorities have changed over the years, and they mirror both global technological advances and Pakistan's own shifting economic priorities and needs. This chart shows the different sectors in which Pakistan received foreign aid. During the early 90s, heavy investment shifted from textiles to power. In the late 00s there was a significant communications boom as internet and telecommunications companies expanded and invested in infrastructure. One should also note how PIA shows up frequently on this table. Many governments (and other countries) have been throwing money at the airline for decades now; its economic conditions do not seem to have improved. (SBP)

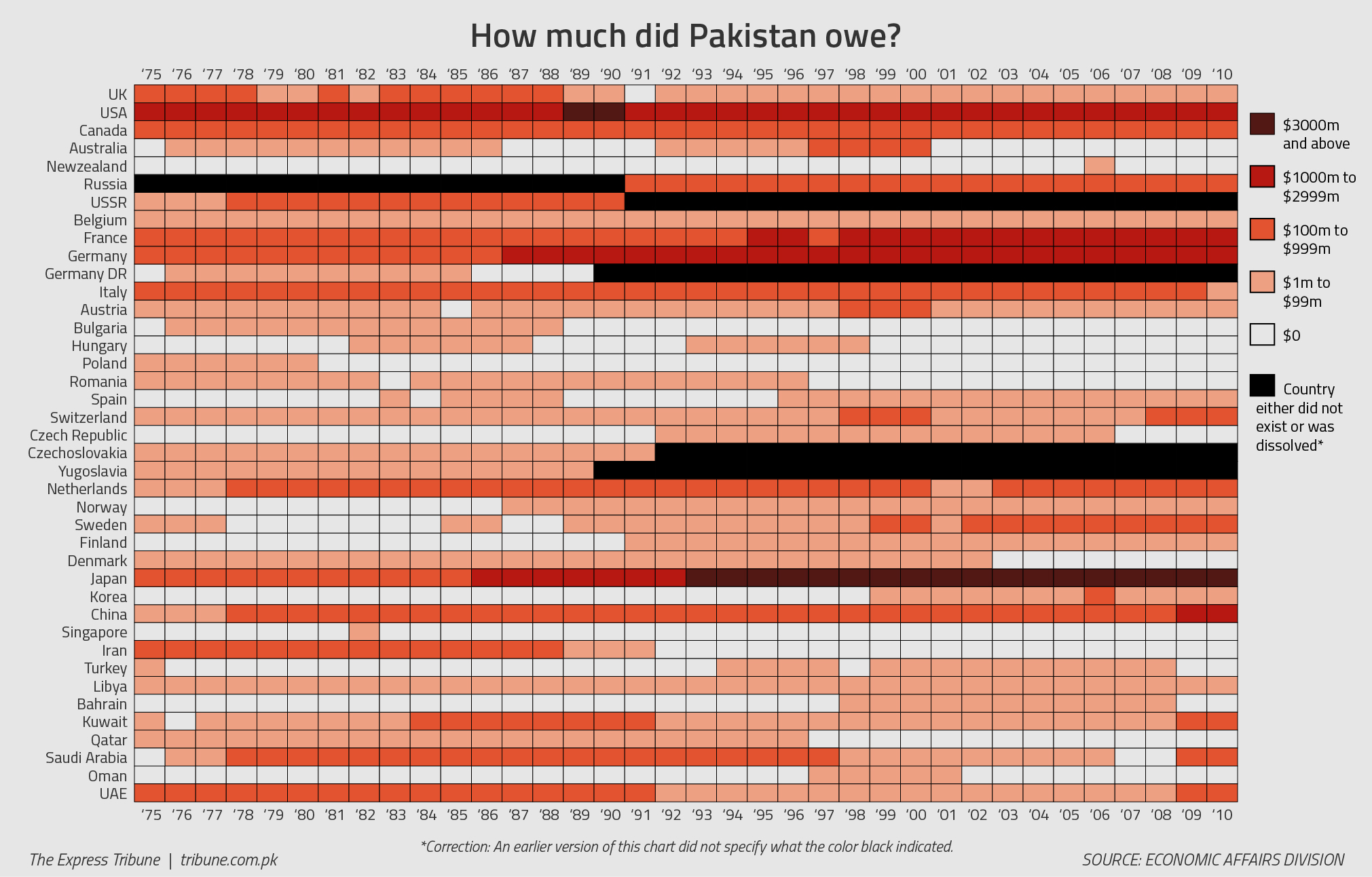

7 Who gives money to Pakistan?

Most countries that constitute the list of Pakistan's debtors are familiar. They include the United States, France, Canada, the United Kingdom, and other predominantly rich, western countries. But a number of countries have also given to Pakistan that may surprise, such as the former republic of Yugoslavia, Czechslovakia, Hungary and Romania. Libya was also a regular contributor at one point; that Lahore's premier cricket venue is named after Moammar Gaddafi should not surprise. The map on the right highlights the countries that have given Pakistan money at some point in Pakistan's history.

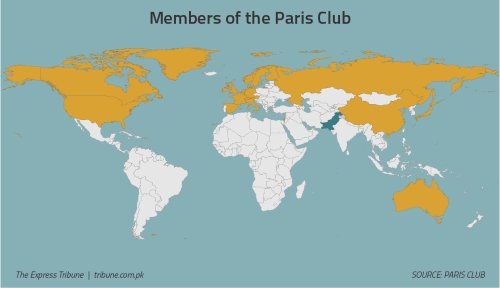

8 The Paris Club

A large portion of foreign aid to Pakistan comes from consortiums. A consortium is a group of countries that collectively decides to give aid. In Pakistan's context, the consortium in question is the Paris Club, a group of 20 of the world's largest economies. The countries on the list are hardly surprising except for Israel, which, for Pakistan, is slightly awkward.

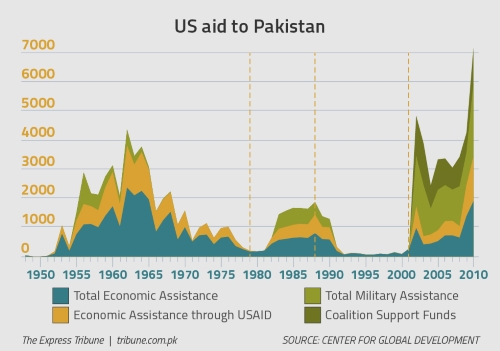

9 Pakistan and the US

The United States is, and has been, Pakistan's biggest foreign aid provider. According to a study done by the Congressional Research Centre, the US has given almost $50 billion in direct aid since 1951. This chart comprehensively describes both the ebb and flow of Pakistan's relationship with the US, and how much of it was centred around security. The chart indicates how military aid to Pakistan can be divided in three specific periods: the Ayub era, when relations were good until the '65 war; under Ziaul Haq, when the Soviet Union invaded Afghanistan; and after 9/11 as Pakistan willfully participated in the Bush-led 'War on Terror'. Very little aid was disbursed during the 90s as sanctions for Pakistan's nuclear program kicked in. The Kerry-Lugar Bill, passed in 2010, ensured that American aid to Pakistan continues beyond this timeline as well, providing at least $1.5 billion per year in development programs.

10 A breakdown of Pakistan's foreign debt

In this chart, we see snapshots of whom Pakistan owed money at various stages in its recent history. This chart (like the others) is a reflection of the geo-political relations of its time. Pakistan has owed money to countries that don't exist any more, like East Germany and Yugoslavia. Iran too was owed money before its revolution in 1979, and good relations with Libya meant more money (as well having a stadium named after its leader). On the other hand, Pakistan's relationships with Saudi Arabia and China, at least monetarily, show gradual progression compared with long-time debt owed to the United States and Japan.

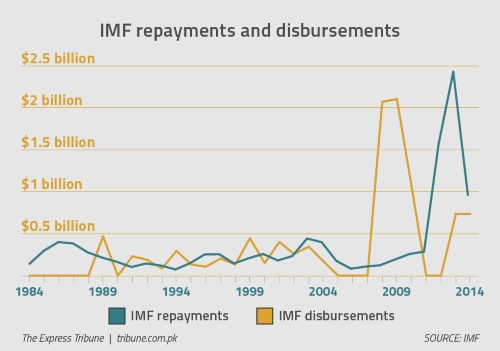

11 Pakistan and the IMF

The International Monetary Fund (IMF) is an international organization that, among other tasks, also functions as a lender to countries that need money urgently. As this chart shows, Pakistan is a frequent customer. The green line shows Pakistan's payments to the IMF, and it is roughly equal to the money Pakistan has received (in yellow). According to IMF's own data, the organization has disbursed more than $10 billion since 1984. The spike in recent years is part of an agreement between Pakistan and IMF to stave of Pakistan's balance of payment crisis. Recently, Pakistan's dollar reserves are almost always close to empty, making it unable to pay for more than a few months' worth of imports. To prevent Pakistan from defaulting, IMF lends money to Pakistan on certain conditions. Essentially these conditions broaden Pakistan's tax base, increase revenue, privatization, deregulation, and are meant to push Pakistan to implement reforms that strengthen its economy. Though there's plenty of controversy both within Pakistan and without over whether these reforms do more harm than good.

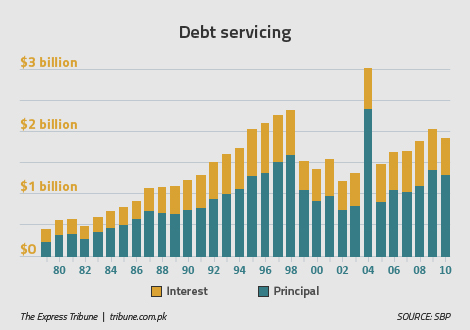

12 Pakistan's debt servicing

Foreign aid can sometimes be a misnomer; almost all of the 'aid' Pakistan receives needs to be paid back. The following chart shows how much money Pakistan has spent each year paying back the debt it owes - with interest. Debt servicing in 2004 was particularly high because Pakistan repaid $1.4 billion to the Asian Development Bank. In fact, this year, Pakistan spent almost half its annual budget on debt servicing, approximately $11.5 billion, although that sum is meant for both foreign and domestic debt. These payments then, take up precious resources in a country that is already wont to spend on education and health.

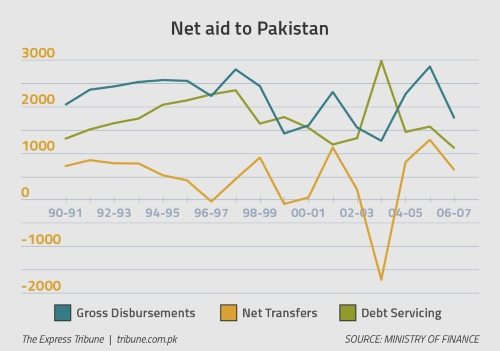

13 Net aid to Pakistan

This chart essentially highlights Pakistan's debt trap - Pakistan needs to borrow in order to pay back, often within the same year. As this chart shows, the net aid Pakistan receives every year (after debt servicing is taken into account) is a fraction of the money that originally comes in. In fact in some years there has been a net outflow, when more money actually went out of Pakistan than what came in. The net aid Pakistan received from 1990-2007 on average was only 15% of the aid Pakistan actually received.

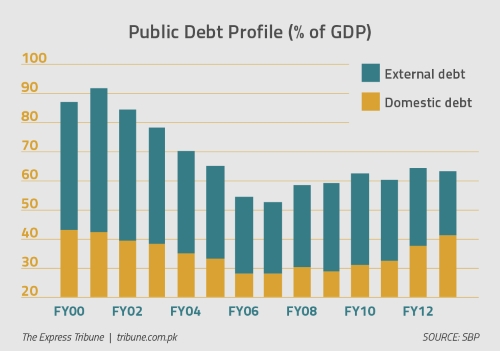

14 Debt rescheduling

A look at this chart shows a healthy decrease in debt during the early 2000s. Don't be fooled into thinking Pakistan was getting its house in order. As of November 1 2001, Pakistan owed the Paris Club $13 billion. Then the War on Terror began, and the United States needed Pakistan's assistance in fighting it. So it was decided that the debt would be rescheduled to 15 years later (the first payment is to be made in 2017). Despite the relief in foreign debt, Pakistan's continuing inability to manage its finances led to a dramatic increase in domestic debt, which more than doubled between 2009 and 2013 under the PPP government.

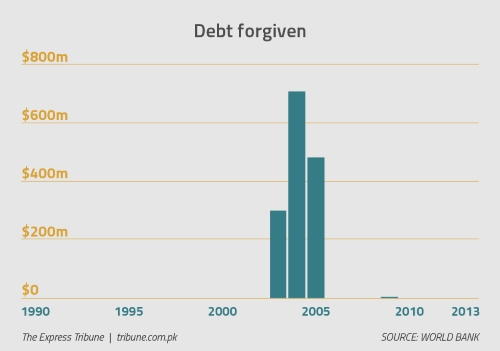

15 Debt forgiveness

It is rarely ever the case that debt is forgiven. If the debtors are charitable, debt is rescheduled or it is provided with concessions like repayment in local currency or reduced interest. In one of those rare instances, Pakistan's debt was forgiven in the years immediately after the 9/11 attacks. This chart shows how some of the debt was forgiven, but it also shows how the forgiven debt was only due to exceptional circumstances, and unfortunately, not to recur.

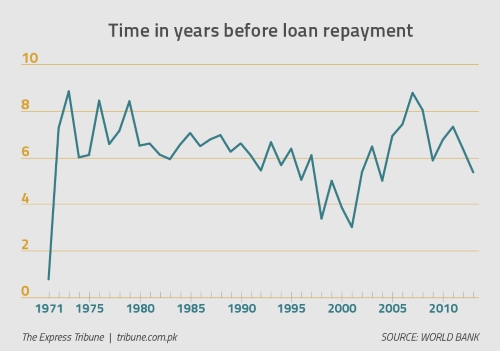

16How long it takes to start paying back debt

This chart shows the grace period that Pakistan has had over the years before the first repayment has to go. While the average has more or less been around five to six years, that time period has been contingent on politics (like every other chart in this feature). In the years after 9/11, the Paris Club rescheduled Pakistan's debt to 2015, and the chart shows how the grace period increased after its lowest point at three years in 2001, before coming back down again as relations with the US soured (again).

© 2014 The Express Tribune